The process of underwriting SBA loans, equipment leases and equipment financing agreements has evolved significantly since the pandemic began over a year ago. The purpose of this article is to share our observations of the 6 key factors considered by analysts in the underwriting process. It is a rare occurrence that applicants are strong in all areas, so the process is subjective in many respects weighing the following key considerations.

- What is your Personal Credit Score?

A 700+ credit score is a safe minimum standard. By looking closely at your credit report, lenders can gauge how well you pay your bills and if you have comparable credit. If an applicant is a homeowner with a house mortgage that is current, an analyst can determine if the applicant is or has serviced comparable credit. Lenders also consider your available credit compared to your current level of debt which is used to calculate your debt-to-income ratio. This ratio is calculated by comparing your annual family income to your current annual debt payments. Some lenders calculate a global debt to income ration which adds the estimated annual debt payment of the loan or lease to your current annual debt payments.

- What in Your Background will lead to your future Success?

Underwriters first look for work experience and/or education in the industry you are applying to secure financing. Previous or current ownership and/or management experience within the industry is especially highly valued. Next, portable skills learned from positions outside the industry including finance, sales, marketing, and management are then considered if you have not previously worked in the industry. Finally, educational degrees in the field or a related field are also considered. In short, creating a resume to highlight and customize your strengths is an important element in securing a loan approval.

- How much is your Equity Injection so you will have “skin in the game”?

Typically, SBA loan applicants must invest at least 10% of the project total cost and rarely are applicants required to invest more than 30% of the total project cost. The total project cost of SBA loans typically includes all monies needed to successfully launch any business including 3 months of working capital. With equipment finance agreements and equipment leases, the equity injection for a new business is typically 20% of the total equipment and soft costs of the total $ amount being requested. The deposit requested for an existing business can be as little as 1 lease payment in advance.

- Do you have a Secondary Source of Income?

Are you keeping your job? Are you married and will your spouse continue to work? These are critical concerns when the underwriter is calculating the debt coverage ratio. In the best case, your family income can support your current personal debt and the ratio exceeds 1.25. If the lender is using a global debt, the estimated repayment of the loan or lease is added to the denominator. As a result, many applicants applying to launch a new business opt to keep their current employment and hire management until the business becomes profitable and can replace the owner(s) income. In the worst case, the owner(s) only income will be the projected annual income from the new business which makes securing an approval difficult unless the applicant(s) have significant liquid assets listed on their personal financial statement.

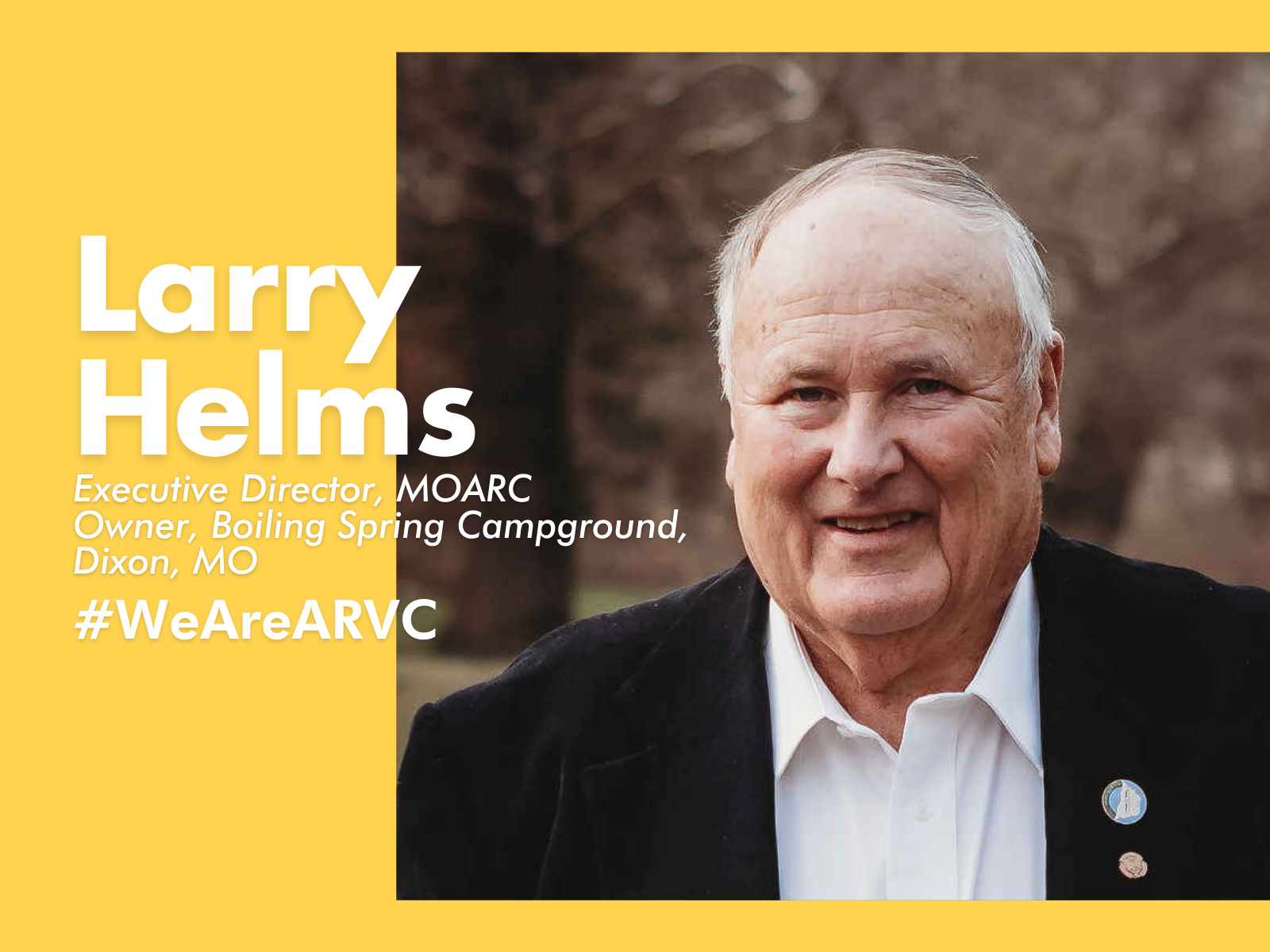

- What is the industry is your business? Is it a Franchise?

In today’s post-COVID environment, securing financing for RV parks and campgrounds are more easily approved while fitness centers and restaurants face an uphill challenge. Established franchisors offer the best chance for applicants to secure financing because the franchisor has established a track record of success which is reported in their annual franchise disclosure document (FDD). Launching a new, non-franchise business is difficult, but not impossible, to secure financing unless the owner(s) have a very strong industry related background. For example, our company recently arranged the financing of a climbing studio owned by a climbing instructor currently working in our Armed Services.

- What is your Collateral?

SBA loans more than $350,000 require the owner(s) to use the business and their personal and/or commercial real estate as collateral up to the loan amount which is discounted on a liquidated collateral basis. Collateral is required at the option of lender for all SBA loans under $350,00. The equipment used to operate any business is highly discounted when valuing collateral for an SBA loan. Alternatively, the equipment being financed using an equipment leases and equipment finance agreements serve as the collateral for the transaction. It is important to point out that collateral is a 2nd form of repayment so it is rarely the main consideration of any lender because they are focused on approving applicants that they believe will be successful in repaying the loan or lease.

For more information, please contact Paul Bosley, Health Club Experts.com and Business Finance Depot. paul@businessfinancedepot.com ; (800) 788-3884 ; www.businessfinancedepot.com

Leave A Comment